Jingyi Li discusses the impact of China’s higher education revolution on the global economy

China’s labor force, the largest in the world, is undergoing a vast and unprecedented upgrade. Higher enrollment rates in post-secondary education, augmented by a surge in the number of Chinese students studying at, and returning from, foreign universities, is rapidly increasing the education and skill level of China’s younger generation. As this more highly skilled generation joins the work force, Chinese firms are provided the necessary talents to compete more successfully in high value-added industries globally. Due to the scale of China’s workforce, this large well-educated cohort—and, by extension, the Chinese firms they join—will not only remake the Chinese economy, it will have a transformational impact on many sectors of the global economy as well.

College: From Exception to Norm

“In 2015, over half a million Chinese—about 1 in every 16 Chinese college entrants—left for foreign universities.”

This is a far cry from the current situation. Today, almost all young people in China attend high school,4 and most high school graduates go on to attend college.5 In fact, in just 18 years China was able to more than septuple the number of students entering university each year, from 1 million in 1997 to 7.4 million in 2015, 40% of them majoring in science, technology, engineering, and mathematics (STEM). Comparatively, about 2.2 million US high school graduates enrolled in universities in 2016.6 Demonstrated a different way, just 6.5% of 18–22 year olds in China were in tertiary education in 1999, compared with 43.4% in 2015.7 Few other countries have been able to achieve such a relative increase in tertiary education in such a short amount of time, and none have approached this absolute number.

*As elementary admission rates are close to 100%, this can be used as a proxy for total population. Drop reflects change in birth rate.

Source: Ministry of Education, China

China now has the largest cohort of college-educated 25–34 year olds in the world8 and continues to add close to eight million more graduates to the labor force each year. This lead is unlikely to be surpassed any time soon. In fact, according to the OECD, by 2030 more than a quarter (27%) of the college-educated 25–34 year olds in OECD and G20 countries will be Chinese, up from 17% in 2013. What is more, this continued rapid growth will occur during a period where China’s share of global population is actually expected to decrease from 19% to 16.7%.9

SHARE OF 25-34 YEAR OLDS WITH A COLLEGE DEGREE

IN OECD AND G20 COUNTRIES

Source: OECD

Question of Quality

Quantity does not necessarily entail quality. The Chinese education system has been criticized for producing graduates that purportedly lack creativity and imagination, and despite the ramping up of China’s higher educational capacity over the past 40 years, only two Chinese universities—Peking University and Tsinghua University—are ranked in the top 50.10 Only 10 other Chinese universities are ranked in the top 500, eight of which placed outside the top 200.

In response, the Chinese government has channeled billions of renminbi into its universities—particularly the top nine through its C9 initiative—in an effort to raise them to world class standards. Additionally, the “Thousand Talents Plan,” instituted in 2008 to, amongst other aims, provide incentives for top Chinese academics at foreign universities “with full professorships or the equivalent in prestigious foreign universities and R&D institutes” to relocate to Chinese institutions, has successfully repatriated thousands of academics. Though these and similar investments have yielded positive results, there is indisputably still much progress to be made. Regional variances in both education attainment rates and education quality remain particularly stark.

Each dollar spent on R&D by Chinese firms goes much further than a dollar spent by their Japanese, Korean, or Western counterparts.

Nonetheless, when compared with India, a country of similar size and comparable higher education enrollment, China’s strides in boosting tertiary education quality stand out. Whereas both countries had broadly similar education levels in terms of both quantity and quality at the turn of the century, today only 5 Indian universities are in the top 500 compared with China’s 12. Moreover, China eclipses India in share of global academic research output and has three times the number of doctoral students. Both are reasonable proxies for education quality.

Beckoning Brainpower

The story of China’s tertiary education boom does not end at China’s borders. In addition to the huge increase in Chinese obtaining college degrees domestically, there has been a simultaneous surge in the number of Chinese students studying abroad, many obtaining their degrees at higher-caliber institutions than those in China. In 2015, over half a million Chinese—about 1 in every 16 Chinese college entrants—left for foreign universities, representing a dramatic 13-fold increase from the under 40,000 that left in 2000.11 Roughly 330,000 went to US colleges.

Source: National Bureau of Statistics, China

While some of China’s study-abroad students, seeking higher salaries and a better quality of life, find permanent employment outside China, the proportion who do not return home has sharply decreased. In 2015 over 400,000 graduates returned to China—approximately 80% of the number that went abroad that same year.12 The current proportion of returnees is much improved from a decade ago, when only around a third returned.

Tightening visa restrictions may limit employment at top global firms to the most talented graduates and those that can otherwise convince employers to undertake an often arduous and expensive sponsorship process. But pull factors are playing a bigger role in the rising proportion of returnees. Quality of life, especially in China’s top-tier cities where most major global Chinese corporations are based, is steadily improving, as are salaries.

Moreover, a surge in capital expenditure—which has largely been neglected by Western companies over the last decade—has enabled many Chinese firms to acquire world-class equipment and expand their productive capacity. R&D spending has similarly increased, led foremost by Shenzhen-based Huawei, the world’s largest telecommunications-equipment manufacturer, which employs 180,000 people. Due to the relatively low cost of young Chinese engineers—the average starting salary of a graduate in China is around $9,000 compared to $50,000 in the US—each dollar spent on R&D by Chinese firms goes much further than a dollar spent by their Japanese, Korean, or Western counterparts, magnifying the impact of Chinese R&D investments. One manifestation of the impact of their R&D expenditure has been a rapid rise in the number of patents filed by Chinese companies, signifying the shift taking place from low to high value-added economic production.

Source: FactSet, Data as of December 31, 2016.

Source: World Intellectual Property Organization

Yet the main reason many Chinese graduates are eschewing the option of working abroad is the desire to be part of, and play an active role in, China’s transformation. High domestic growth and the fast pace of technological change provides returning graduates with greater opportunities to move up the management chain and assume more responsibility at an early age than they would receive outside China. This fast-changing economic environment also gives rise to meaningful and challenging professional opportunities such as expanding business into a new region, developing new product lines, or starting new enterprises entirely.

Harbingers of the New China

China’s recent performance in a number of international arenas illustrates the technological prowess unleashed by its increase in human capital and the greater R&D capacities of its top firms. For example, in late 2016, Tencent broke four world records at Sort Benchmark, a global computing “Olympics” of sorts dominated by Chinese tech giants since 2014. The Tencent team beat previous winners Alibaba and Baidu—all Chinese companies—by sorting 100 terabytes of data in 98.8 seconds, smashing Alibaba’s 2015 world record of 329 seconds. A Chinese-made supercomputer, Sunway TaihuLight, is now by far the fastest in the world; three times faster than Tianhe-2, the previous record holder (also Chinese), and five times faster than the top US supercomputer, Titan, which is now ranked third globally.13

“While this education revolution is challenging firms globally, it is also providing new opportunities.”

China’s recent achievements have not been limited to high-speed computing, however. For example, between 2012 and 2015, the number of articles published by Chinese scientists in the top 68 natural science journals grew by 14% per year, putting China ahead of Germany, the UK, and Japan, and rapidly catching up with the US. China has won 19 of the past 28 International Mathematical Olympiads and placed in the top three 26 times in the same period.14 In early November 2016, a young Chinese team successfully launched Long March 5, a heavy lift launcher rocket in the same league as the current leader, Delta 4-Heavy (US), and more powerful than Ariane 5 (Europe) and Proton (Russia). This achievement, which was broadcast live on Chinese television, is particularly noteworthy as the average age of the Long March 5 development team was just 33 years old.

Commenting on this remarkable transformation, Harding Loevner Analyst Jingyi Li asserts that as Chinese graduates “gain more experience in high value‐added activities after college and develop genius, grit, and gumption, they will become even more competitive and bring a sea‐change to the global talent pool.” The far-reaching implications of this change, argues Li, have to date been underappreciated by many outside China. “There has been a long-standing stereotype that China is great at copying designs, assembling components, and producing cheap products, but not capable of much more than that,” explains Li. “Though this view may describe the past, the future will be very different.” Harding Loevner Analyst Wenting Shen concurs, claiming that “in the not-too-distant future, ‘Made in China’ will no longer be associated with low value.”

A World of Impact

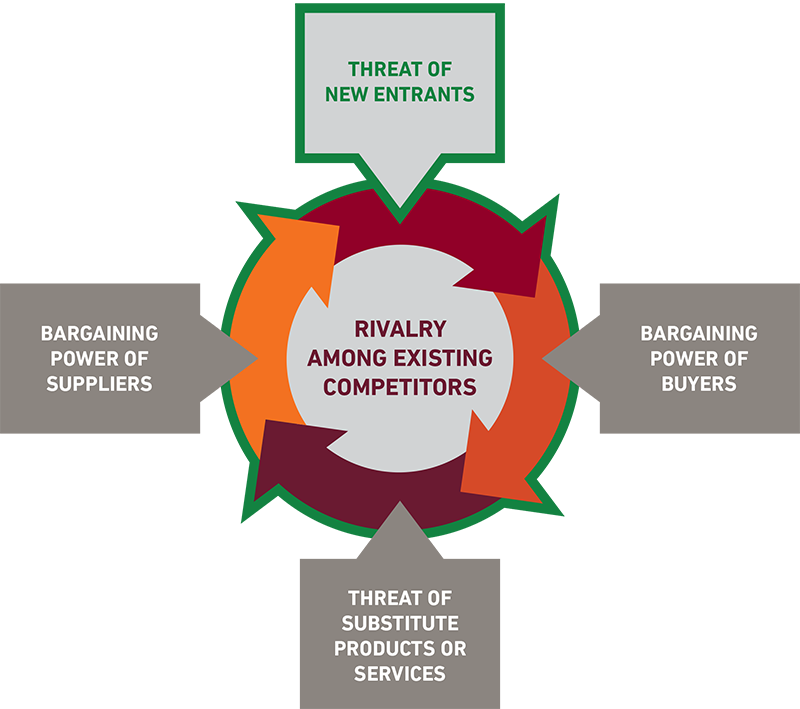

Looked at through the lens of Michael Porter’s five forces, China’s more educated work force will have two primary effects on firms exposed to global competition. First, many Chinese companies will be able to use these educated workers to surmount long-standing barriers to entry into the more profitable areas of their sector’s supply chain. Second, greater efficiency and productivity afforded by these highly educated workers, coupled with the recent increase in R&D and capital expenditure, will increase the intensity of rivalry within the global industries in which Chinese firms already compete. Both these effects will put negative pressure on profits for all firms competing in their particular industry or instigate further innovation, both of which will accrue to the benefit of consumers.

Michael Porter’s Five Forces model that determines the profitability of firms within an industry

An increase in any of these forces puts negative pressure on profits for industry participants.

According to Wenting Shen, these dynamics are already playing out in the Information Technology sector. “As China moves up the technology value chain, it upgrades from merely assembling hardware to developing and manufacturing value-added components and products themselves. This has been possible due to expertise gained from doing business with global technology leaders, burgeoning access to highly educated yet still affordable engineers, and smart acquisitions made with saved up capital.”

For example, in the smartphone industry, many Chinese firms such as Sunny Optical are increasingly designing and producing chips, sensors, lenses and acoustic components—rather than just assembling them. This shift allows these companies to capture a greater share of the industry-wide profits, even as the overall level of profits declines due to the increased intensity of rivalry. Similarly, Haitian in plastics machinery, Hikvision in security cameras and imaging analysis, and Shenzhen Inovance in industrial automation have each taken market share at the expense of their global competitors as they take advantage of the skills of the expanding domestic talent pool.

“China’s younger generation is now more akin to their counterparts in developed economies than to their parents’ generation in China.”

While this education revolution is challenging firms globally, it is also providing new opportunities for firms, both Chinese and global, who sell to Chinese consumers and corporations. As China’s educated younger generation helps raise the productivity of their employers, they command higher salaries. This increase in disposable income, in turn, is raising demand for high-quality and discretionary products, benefiting companies such as Nike and L’Oréal. Demand for travel services is on the rise as well, offering firms in this sector, such as online travel service provider Ctrip.com, plenty of potential for expansion. Ever-increasing R&D budgets and capital expenditure is also increasing corporate demand for expensive research and manufacturing products such as laser systems produced by IPG Photonics and robot arms produced by Fanuc.

Given the rapid increase in education, skills and productivity, in these terms China’s younger generation is now more akin to their counterparts in developed economies than to their parents’ generation in China. Jingyi Li believes this change to be profound for the global economy, arguing that “just as older and less‐educated labor from China disrupted the low‐end of the global labor pool in past decades, the younger and better‐educated generation in China is now disrupting the middle class of the developed world.” With millions more college graduates added to the Chinese work force each year, and with stereotypical notions of the Chinese economy becoming increasingly outdated, companies that compete in a global marketplace need to up their game.

What did you think of this piece?

Contributors

Harding Loevner Analysts Jingyi Li and Wenting Shen, CFA contributed research and viewpoints to this article.

1“Education Statistics – All Indicators,” World Bank Databank, accessed June 2, 2017.

2Ibid.

3“China Statistical Yearbook 2016,” National Bureau of Statistics of China, accessed June 2, 2017.

4“Gross Enrollment Ratio by Level of Education,” UNESCO Institute for Statistics, accessed June 2, 2017.

5“Promotion Rate of Graduates of Regular School by Levels,” Ministry of Education, China, accessed June 2, 2017.

6US Bureau of Labor Statistics, “College Enrollment and Work Activity of 2016 High School Graduates,” news release, April 27, 2016.

7“Gross Enrollment Ratio by Level of Education,” UNESCO Institute for Statistics, accessed June 2, 2017.

8OECD. “How is the global talent pool changing (2013, 2030)?” Education Indicators in Focus, April 2015. Accessed June 2, 2017.

9“World Population Prospects, the 2015 Revision,” United Nations Department of Economic and Social Affairs, accessed June 2, 2017.

10“World University Rankings 2016-2017,” Times Higher Education, accessed June 2, 2017.

11“China Statistical Yearbook 2016,” National Bureau of Statistics of China, accessed June 2, 2017.

12Ibid.

13“November 2016,” TOP500, accessed June 2, 2017.

14“Results,” International Mathematical Olympiad, accessed June 2, 2017.

Disclosures

The “Fundamental Thinking” series presents the perspectives of Harding Loevner’s analysts on a range of investment topics, highlighting our fundamental research and providing insight into how we approach quality growth investing. For more detailed information regarding particular investment strategies, please visit our website, www.hardingloevner.com. Any statements made by employees of Harding Loevner are solely their own and do not necessarily express or relate to the views or opinions of Harding Loevner.

Any discussion of specific securities is not a recommendation to purchase or sell a particular security. Non-performance based criteria have been used to select the securities identified. It should not be assumed that investment in the securities identified has been or will be profitable. To request a complete list of holdings for the past year, please contact Harding Loevner.

There is no guarantee that any investment strategy will meet its objective. Past performance does not guarantee future results.

© 2024 Harding Loevner

Disclosures

The “Fundamental Thinking” series presents the perspectives of Harding Loevner’s analysts on a range of investment topics, highlighting our fundamental research and providing insight into how we approach quality growth investing. For more detailed information regarding particular investment strategies, please visit our website, www.hardingloevner.com. Any statements made by employees of Harding Loevner are solely their own and do not necessarily express or relate to the views or opinions of Harding Loevner.

Any discussion of specific securities is not a recommendation to purchase or sell a particular security. Non-performance based criteria have been used to select the securities identified. It should not be assumed that investment in the securities identified has been or will be profitable. To request a complete list of holdings for the past year, please contact Harding Loevner.

There is no guarantee that any investment strategy will meet its objective. Past performance does not guarantee future results.

© 2024 Harding Loevner