At Harding Loevner, we are quality growth investors, which means we seek to invest in well-managed, financially sound businesses that can sustain profitable growth across economic cycles. But what do we mean when we talk about quality and growth as attributes of a company? While there is no standard definition of quality or growth in the investing world, our quality rankings consider factors such as the stability, level, and trend of a company’s profitability as well as its balance-sheet strength, and our growth rankings consider historical and estimated future changes in sales, earnings, and cash flows.

How companies perform on those measures can change over time. Industry dynamics evolve, which can lead to a shift in competitive positioning. Macroeconomic cycles and deviations in management strategy can also alter the long-term outlook. Even companies that consistently rank highly for quality and growth must be continuously assessed for signs of deterioration in their financial health, competitive advantages, and other factors. The challenge isn’t just determining the businesses that meet our criteria today, but also which businesses will sustain their quality and growth characteristics over the long run.

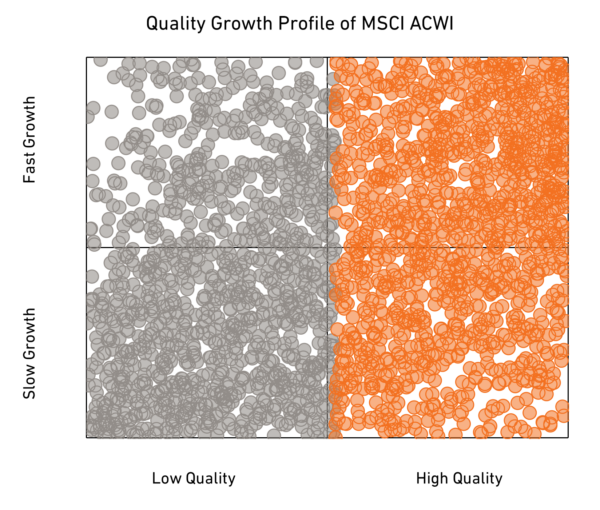

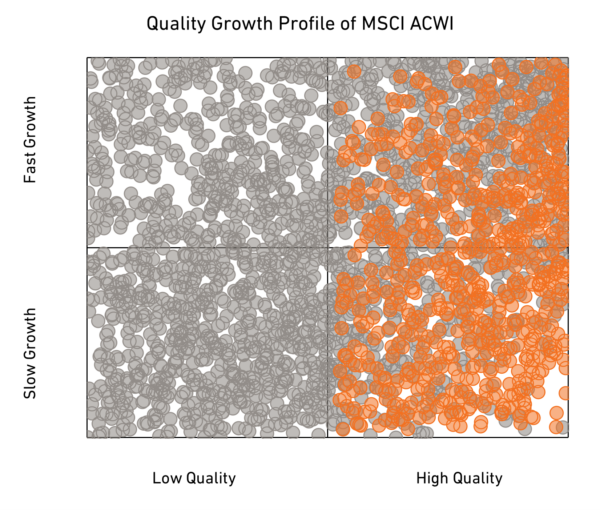

The charts below illustrate how variable those characteristics are. The bubbles represent the roughly 2,700 stocks that were in the MSCI All Country World Index (ACWI) at the end of 2018. In the tab for 2018, they’re split down the middle such that the top half of stocks (the orange portion) were considered high quality, based on their Harding Loevner quality scores at the time. But over the next five years, the characteristics of the companies changed. Now click the tab for 2023. It shows that only 25% of index members were also above the threshold that was set in 2018.

HOLT, FactSet, MSCI, data as of December 31, 2023

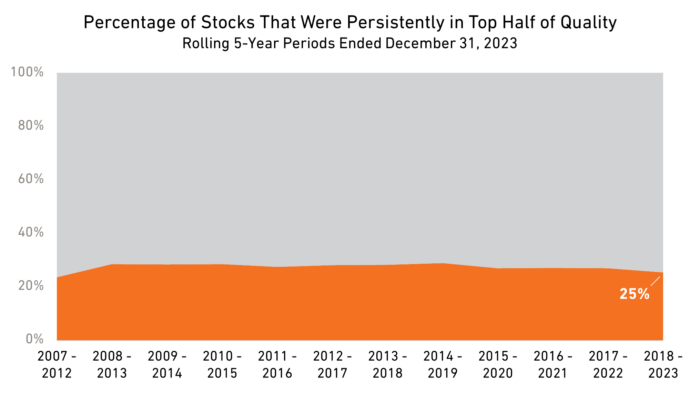

In fact, in any five-year period only about a quarter of companies were in the top half of quality at the start and the end of the period:

HOLT, FactSet, MSCI, data as of December 31, 2023

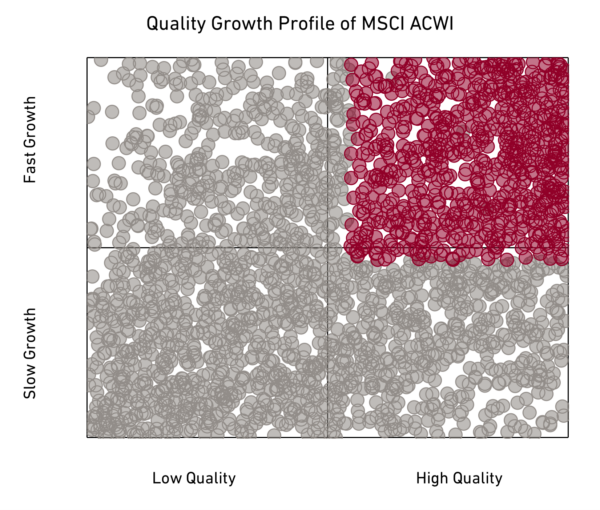

Identifying a persistently high-quality and fast-growing company is even more difficult, as the following charts show. Clicking the tab for 2023 reveals that only 10% of companies in the index remained above the threshold for quality and growth that was set in 2018. This means investors can expect that the majority of high-quality, growing businesses today will not score as high-quality, fast growers in five years.

HOLT, FactSet, MSCI, data as of December 31, 2023

TSMC and France-based Dassault Systèmes are among companies that, because of their strong competitive advantages, have managed to sustain their quality and growth rankings in our measurements. TSMC is one of the few reliable, high-volume global manufacturers of advanced and specialty semiconductor chips, a strength that stems from decades of proprietary technology development and disciplined execution. Dassault is a provider of software for virtual product design that has one of the broadest offerings in the space, able to be used by customers in multiple industries. Its high proportion of recurring revenue from software subscriptions and a loyal customer base have insulated the business from economic downturns. In fact, both TSMC and Dassault have remained in the top quadrant of quality and growth every year for the past 15 years (and have been owned in Harding Loevner’s International Equity model portfolio for that entire time). But as the data show, such companies are the outliers.

Quality growth investing also isn’t as simple as buying and holding companies that score in the top quadrant of our rankings—or immediately discarding the stock of a company that has strayed from that territory. These scores are merely proxies that attempt to capture each company’s financial strength, competitive advantage, and the projected trajectory of their growth. Indeed, fundamental analysis can sometimes lead us to identify companies that meet our investment criteria even if they don’t, at the moment, score in the top quadrant. Therefore, it’s better to analyze and monitor a business’s quality and growth through the fundamental research that informs these scores rather than speculate on potential movements in the scores themselves.

At Harding Loevner, this process begins with an analyst examining a company’s competitive position within its industry using the framework of Porter’s Five Forces, which is based on Harvard University professor Michael Porter’s book, Competitive Strategy: Techniques for Analyzing Industries and Competitors. Once a company is affirmed to meet our investment criteria, analysts continue to track and debate the strength of its fundamentals and growth potential, communicating with colleagues when these factors are at risk of deterioration. It’s because we know quality and growth may not always persist that our research process to evaluate these characteristics must.

What did you think of this piece?