When it opens in 2023, the Gemini Solar Project will be the largest solar panel field in US history, sprawling over an area half the size of Manhattan in Nevada’s Mojave Desert and capable of generating 690 megawatts of electricity, enough to meet the peak consumption of more than 400,000 households. The project’s developer, a consortium led by Australia’s Quinbrook Infrastructure Partners, chose the site because it meets every criterion for a successful solar energy project: it’s on cheap federal land in one of the sunniest spots on Earth. It is also located just 30 miles northeast of Las Vegas and near two major power substations.1 Situating a green energy facility close to end users reduces the amount of power lost over transmission lines.

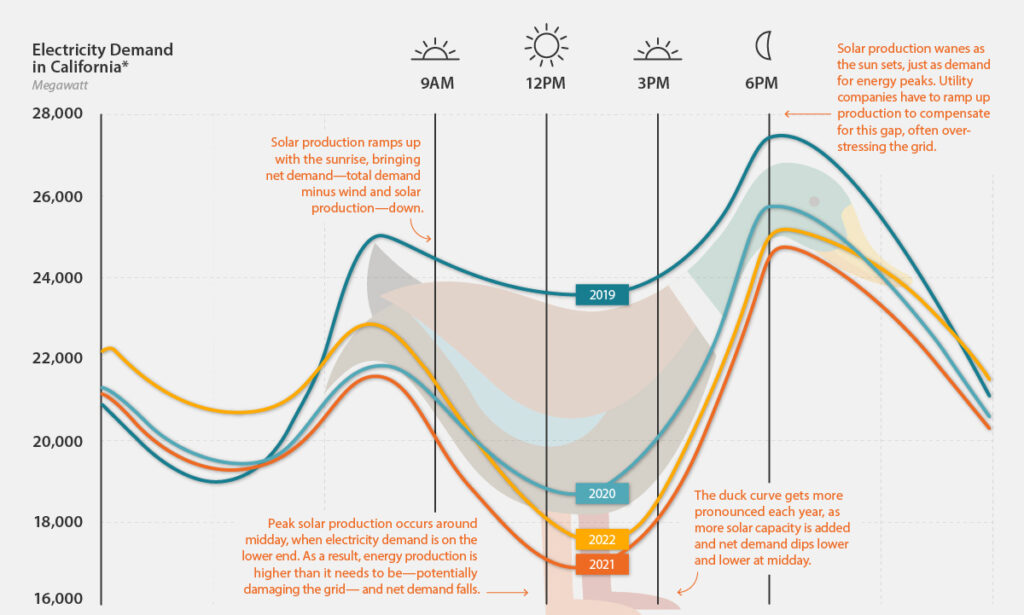

But solar projects face another challenge: one not of location, but of timing. While solar electricity output is obviously reliant on the sun, power consumption in southern Nevada and the part of California that will use the Gemini project’s electricity tends to peak after dark. This pattern of demand is captured in the so-called “duck curve” that charts the fluctuations in net demand—total electricity demand minus wind and solar production—over the course of the day. In states like Nevada and California that are heavily dependent on solar power, a large and growing mismatch exists between the midday hours when the most power is generated but demand is lowest—the “belly” of the duck—and those hours early or late in the day (the “tail” and “neck” of the duck), when solar production is low and demand is high.

The “Duck Curve”

*Total demand minus wind and solar on the first Saturday of February from 2019 to 2022.

Source: California Independent System Operator; Visual Capitalist.

Too much power on the grid can be as much of a problem as too little, creating price dislocations and potentially overloading power lines and transformers. To shrink the duck’s belly and get power from the Gemini project to customers when they need it most requires a way to store energy that’s generated earlier in the day. The most obvious solution is battery storage, and for years developers have been trying to use large arrays of lithium-ion batteries for this task. The problem is those types of batteries have traditionally come with a small risk of bursting into flames. Such a fire is scary when it’s confined to an electric vehicle (EV), burning hot enough to liquefy the chassis of the car. It’s catastrophic when there are thousands of those batteries stacked together in battery energy storage systems (BESS) like the one required at the Gemini project. One fire at an early-generation BESS facility in Victoria, Australia, in August 2021 burned for three days.

But over the past 18 months, more stable and efficient battery designs and competition between two companies across both the EV and power generation supply chains have led to reduced fire risk and lowered the cost of new BESS so they have also become economical for alternative energy producers. As a result, the BESS market has exploded—in a good way. A July 2022 Alliance Bernstein report predicts that global BESS capacity, which stood at 38 gigawatt hours (GWh) in 2021, will reach 1,464 GWh by 2030, a compounded annual growth rate of 50%. At the Gemini project alone, Quinbrook will spend hundreds of millions of dollars to install 1.4 GWh of storage capacity, an amount equal to about a tenth of all the storage capacity previously installed in the US combined.

This rapid growth will be a boon to the Gemini project’s battery supplier, China-based CATL, the world’s largest battery maker and the leading producer of the type of batteries used in the new wave of BESS facilities. “Until a couple of years ago, management saw BESS as a relatively small part of the company’s business, ancillary to its core EV-related production,” says Lee Gao, an analyst at Harding Loevner. “Now, it looks like it could double as a percentage of revenues and profits to 30% within the next few years.”

They Didn’t Start the Fire

For years, CATL and BYD, a Chinese EV car and battery maker backed by Warren Buffett that competes with CATL in the lithium-ion market, each made two types of lithium-ion batteries. Lithium iron phosphate (LFP) batteries had a lower energy density but were more chemically stable and less costly to produce, perfect for powering cheap, durable, limited-range EVs popular with Chinese consumers. The other type, nickel magnesium cobalt (NMC) batteries, were more energy dense, allowing for greater range at a smaller size and weight, making them more appealing to high-end overseas automakers like Tesla and BMW, despite their chemical instability. But in 2020, BYD introduced a new LFP battery that was as safe as its previous models and as energy dense as some NMC packs. To promote its new design, the company released a YouTube video showing its battery getting impaled by a nail without so much as cooking an egg which had been placed on top, while a NMC battery pack immediately bursts into flames when subjected to the same test.

Part of the “nail test” video released by BYD in March 2020 slyly trolling the nickel-magnesium-cobalt (NMC) lithium-ion batteries made by CATL and other manufacturers and promoting BYD’s new lithium-iron phosphate (LFP) technology. In the BYD LFP portion of the video not shown here, the egg placed atop the battery didn’t even cook.

The video, which was picked up by bloggers and news organizations around the world, prompted a series of public exchanges between the two firms in which CATL took issue with the relevance of the test and noted that, in any event, BYD’s design was just one of many CATL was considering for its own new LFP batteries. The hype over BYD’s product helped ignite public interest in the improved technology, and by the following year CATL was selling its own higher-density LFP batteries. The combination of better safety with higher density was a hit with CATL’s biggest customers, including Tesla, which switched from using NMC batteries to LFP in all but its highest-range cars. By October 2022, nearly two-thirds of CATL’s EV battery production was LFP, up from less than half two years earlier.

The LFP arms race between BYD and CATL led both to ramp up production, increasing their economies of scale and driving down the marginal cost of LFP production. Those factory savings, in turn, caused LFP cell prices to fall, from about US$120 per kilowatt hour (kWh) in early 2019 to just above US$90 per kWh by 2021.2 In the power generation market, where tax credits in places like the US knocked another 30% or more off the deployment cost of a battery storage system, the new lower prices brought batteries into the range for alternative energy developers where the economics started to work.

Batteries lose storage capacity over time and degrade more quickly the more they are used. When battery packs were more expensive, developers who did use the old NMC packs often practiced what’s called “frequency regulation,” prolonging the life of their battery system by not discharging it until they could be sure of getting the highest price for their power. But with less expensive batteries, it’s possible to replace the packs sooner, reducing the need for such frequency regulation. That lets developers store more power and respond more regularly to surges in demand for power on the grid without worrying about their batteries degrading.

Historically, large-scale alternative energy storage was accomplished primarily through mechanical solutions: for example, using surplus electricity from a solar or wind farm to pump water up a hill, then releasing that water to turn turbines when demand for electricity is higher.

In Europe, residential BESS sales have increased threefold in 2022 as the war in Ukraine has sent energy prices soaring and homeowners rushing to take advantage of financing subsidies for home-based solar and storage systems.

In China, the world’s largest user of pumped hydro for energy storage, the comparative convenience and improved economics of simply being able to truck in a few dozen shipping-container-sized battery packs instead of constructing an enormous hydraulic system led to a shift in policy emphasis toward battery storage. National energy officials have set a target of 100 GWs of battery storage by 2030. Moreover, many local governments now require that any new wind or solar generation project come with storage that can cover 10‒30% of its capacity—which at most sites can only practically be met with BESS.

Policymakers in Europe, meanwhile, have set their own 2030 target of 200 GWs of battery energy storage. There, home storage systems account for 46% of current capacity, by far the most of any major market. Residential BESS sales in Europe have increased threefold in 2022 as energy prices have soared due to the disruptions caused by Russia’s invasion of Ukraine and homeowners have rushed to take advantage of their governments’ financing subsidies for home-based solar and storage systems. In parts of the EU, homeowners can now power and heat their homes with roof-based solar panels for as little as 40 euros a month, including the installation costs of the panels and a residential-sized BESS unit, which employ the same LFP cells as a utility-sized pack.

And then there are the policy twists and turns in the US.

Duck Soup

The 2022 Inflation Reduction Act (IRA) is a major shot in the arm for US alternative energy generation. The legislation contains US$369 billion in subsidies for alternative energy, potentially enough to cut America’s 2030 greenhouse gas emissions by 40%. Some of the subsidies simply restore tax credits that were set to expire. Another tax credit, however, specifically encourages the construction of standalone BESS projects that operate independently of a wind or solar farm.

Previously, BESS installations could only qualify for tax credits if they were part of a wind or solar farm. Not only did the storage have to be built concurrently with and located at the same site as the energy generation facility, it had to receive all its energy from that solar or wind source.

To understand the unintended consequences of this policy, we need to refer back to the duck curve. Incorporating a BESS facility into a solar farm should in theory help relieve the pressures on the grid by holding back some power to extend the delivery period further into the duck’s neck. But because of the way the old tax laws were written, any new BESS facility also came with new solar capacity, so the net effect was often to just fatten the duck’s belly and “make the mismatches even worse,” says Gao.

With the new standalone tax credit, a developer could build a BESS facility on the outskirts of Los Angeles that charges its batteries from solar farms in the Mojave during the day and discharges that power to homes and businesses in the evening. Then overnight, when electricity rates drop, the facility can recharge with power from the grid so that the batteries are ready to start discharging again as demand increases before sunrise.

Harding Loevner Analyst Lee Gao says that, according to his industry sources, the new BESS provision in the 2022 US climate change legislation “could be a game-changer.”

“Our industry sources think this standalone provision could be a game-changer in terms of adding to grid stability,” says Gao. There will need to be other solutions to plug the weather-related gaps that periodically bedevil any alternatives-heavy electrical grid. For instance, many utilities plan to replace their aging continuous-firing gas plants with solar and wind systems with BESS storage. What will still be needed, however, are more, smaller “black start” gas plants that can be quickly fired up to provide backup for the green energy sources. “That’s going to take time and money, too,” says Gao. “But at least now we’re starting to see more of a path forward.”

The architects of US trade policy with China seem to recognize the critical role of BESS—and CATL—in the energy transition. EV batteries produced in China aren’t eligible for subsidies under the new law, but there’s no such prohibition on BESS, perhaps a tacit acknowledgment that CATL has become too integral to BESS production for US climate objectives to be met without it. CATL is exploring new facilities in Mexico or the US to produce EV batteries to overcome the hurdles in the new law, but until then, it’s continuing to grow its BESS business in the US.

The company is also on the forefront of developing the next next generation of battery chemistry based on sodium-ion technology (that’s right, essentially making batteries from salt), which is easier on the environment and even less costly to produce than LFP and involves even lower (i.e., next to zero) fire risk. Though CATL does not expect to reach full commercial scale for several years, it plans to start shipping sodium-ion batteries in 2023. Because the cells are still slightly less energy dense than LFP ones, some of their first high-volume uses could be for BESS projects, where, unlike in an EV, size and weight are less of a priority.

“BESS has emerged as this nice supplement and stabilizer to the company’s earnings,” says Gao. “If US industrial policy temporarily causes the company to lose EV-related market share in the US, BESS should help smooth out the lumps until the North American plants are up and running. Or if, as I think is more likely, everyone realizes that without CATL there is no way the US can meet its EV targets either, then the BESS opportunity is all additive.”

What did you think of this piece?

Contributors

Analyst Lee Gao contributed research and viewpoints to this piece. ESG Associate Maryna Arabei, CESGA also contributed research.

Endnotes

¹The Gemini Solar Project site also sits in the migration path of the desert tortoise, a charismatic creature that can live to 80 years old and whose environmental defenders tried to get the project moved. Quinbrook offered to move the tortoises instead, rounding up as many as it could find with the intent of returning them to the property after the work is finished. How the reptiles react to 1.8 million solar panels angled overhead remains to be seen.

²More recently, tightening global lithium supplies and supply chain shortages have caused the decline in LFP prices to slow and even back up a bit. However, as this occurred at the same time oil and gas prices were also rising, the net effect on LFP demand has largely been a wash. CATL is also relatively insulated from some of these forces because it secured its own dedicated lithium supply in western China and its investments in other reserves around the world.

Disclosures

The “Fundamental Thinking” series presents the perspectives of Harding Loevner’s analysts on a range of investment topics, highlighting our fundamental research and providing insight into how we approach quality growth investing. For more detailed information regarding particular investment strategies, please visit our website, www.hardingloevner.com. Any statements made by employees of Harding Loevner are solely their own and do not necessarily express or relate to the views or opinions of Harding Loevner.

Any discussion of specific securities is not a recommendation to purchase or sell a particular security. Non-performance based criteria have been used to select the securities identified. It should not be assumed that investment in the securities identified has been or will be profitable. To request a complete list of holdings for the past year, please contact Harding Loevner.

There is no guarantee that any investment strategy will meet its objective. Past performance does not guarantee future results.

© 2024 Harding Loevner