Ippudo, a Japanese ramen chain, is one of the world’s great soup success stories. Founded in 1985 in Fukuoka Prefecture on the north of Kyushu island in Japan, the company got its start as a single noodle shop serving the local tonkotsu style of ramen, a soup that originated as humble street food for workers in the city’s municipal markets. Of all the different types of ramen, tonkotsu is the most labor intensive. To create the broth, pork bones (tonkotsu) are boiled for 18 hours, while the cook skims off the fat and adds garlic, ginger, onion, scallions, and chicken carcasses among other ingredients. Once the liquid thickens and acquires a milky white sheen, it simmers for another 24 hours before the bones are picked out and a second, soy-based broth called kaeshi is stirred in; upon serving, each bowlful of broth and noodles (traditionally served soft outside but crunchy in the center) is topped with slabs of barbecued pork shoulder and belly. Such is the popularity of Ippudo’s specialty that the chain has grown to more than 100 outlets throughout Japan as well as locations in two dozen other cities around the world, from San Francisco to Paris.

Reaching that scale was a challenge. To go from one shop to over a hundred, Ippudo would have to industrialize its cooking, standardizing its production methods to control quality and reduce the need for skilled culinary workers. Industrialization of food production has been a key part of the growth recipe for nearly every major restaurant chain from White Castle onward. In Japan, where the population has been trending older since the 1950s and the birth rate is at its lowest level since 1874, industrial production is even more crucial due to the scarcity of workers. In the food, hospitality, and other service industries alone, unfilled positions are expected to reach four million by 2030.1 Employing chefs to prepare each batch of soup would be prohibitive, if not impossible.

At the same time, much of Japanese cuisine, including the aforementioned two-day vigil over a pot of boiling bones, isn’t easy to produce with industrial methods. So, how did Ippudo square the circle of its growth ambitions, artisanal product, and tight labor market? Although the company has never admitted it publicly, it seems that some years ago Ippudo went the way of dozens of other ramen chains in Japan: for its bone broth it has turned to Ariake, a secretive industrial food company that has cracked the code to producing unique essential ingredients at scale.

Watch as Harding Loevner’s Yoko Sakai and Takayuki Hayano talk ramen over bowls of the famed tonkotsu style of the soup made by Ariake… er, Ippudo.

Ariake has little in common with major Western restaurant supply companies like Sysco or US Foods, which purvey almost every manner of semi-prepared food or ingredient. Perhaps Ariake’s closest comparator would be a cross between a proprietary flavors maker like International Flavors & Fragrances (IFF) and Willy Wonka’s chocolate factory.

In describing Ariake’s significance, Yoko Sakai, Harding Loevner’s Director of Research, recalls a line from one of her favorite movies, Tampopo, a 1985 “ramen Western” about Japan’s obsessive food culture:

“The broth is the soul of the ramen.”

“That’s really the core of what Ariake is doing,” she says. “Scaling soul.”

Eastworld

It is no coincidence that Japan, long challenged by its demography, has given birth to many of the world’s most advanced industrial automation systems. In recent years, as part of the government’s “Society 5.0” industrial roadmap, it has strived to replicate the tremendous productivity gains achieved in the automobile and electronics sectors in service sectors such as food and hospitality, where productivity has lagged, burnout is common, and the shortfall of workers is dire. Visit Japan and you will find robots working as baristas and bartenders—as well as assisting sushi chefs in assembling their creations: one model from Tokyo-based startup Suzomo can form 4,800 nigiri rice balls per hour.

While robots can prepare sushi rice balls, they aren’t yet able to handle work that requires dexterity, such as slicing fish. That has always been a challenge with automating food preparation: while parts of the industry lend themselves to automation, other parts defy it—and it is not always immediately clear which is which. As The New York Times has reported, a few years ago a Japanese food processing plant tried out a prototype robot designed to remove potato eyes.2 Removing the blemishes is the kind of repetitive, time-consuming work that seems perfect for a robot. Except it isn’t. The robot’s sensors weren’t sensitive enough to spy every eye. And, while human hands can rotate a potato in any direction, the robot was limited in the number of axes along which it could operate. As a result, many of the potatoes were either under- or over-pared, and the robot was eventually removed.

But automation is only one way to improve productivity in a labor-challenged society. Another is through the outsourcing of labor-intensive functions. A restaurant chain with a hundred or so locations probably has the volume to justify centralizing and industrializing parts of its food preparation on its own. Still, its volumes aren’t going to approach the scale of a food manufacturing company that serves hundreds of customers with thousands of restaurants. A specialist food manufacturer able to run its machines all day, every day can justify more investment in equipment and potentially automate more of its processes, creating additional labor savings. It may hit on proprietary automation solutions that elude other producers. Even if a restaurant chain chooses to keep its most proprietary dishes or preparation steps in house, outsourcing certain routinely prepared base items can gain it efficiencies, especially in a country where finding enough workers to staff even a heavily automated central kitchen could be a challenge.

Outsourcing can also be used to offload functions peripheral to the core business. Companies in many countries increasingly outsource administrative tasks such as accounting, IT support, human resources, customer service, and routine legal work to so-called business process outsourcing (BPO) firms. In English-speaking countries, the practice has become as much a labor cost arbitrage strategy as a labor-saving one, with the BPO firms frequently locating their service centers in countries like India or the Philippines where wages are lower and skill levels and English proficiency relatively high. In Japan, the language barrier is a big impediment to finding qualified workers overseas. So, most Japanese BPO activity tends to be domestically based, and whatever arbitrage savings that are achieved come from locating the BPO centers in more outlying areas instead of, say, downtown Tokyo. Nevertheless, for many Japanese employers these domestic BPOs have become another of the survival tactics for competing in chronically worker-strapped Japan, enabling the employer to free up critical layers of management oversight to focus on high-level tasks. In fact, demand for these types of labor efficiencies have made BPO one of Japan’s fastest growing industries. Excluding call center outsourcing (whose roots date farther back in the country), BPO revenue growth over the past several years has averaged 4-5% a year—about 4-5 percentage points faster than Japanese GDP—placing BPO in a similar league as other demographically aligned segments like home health care services (13%) and adult diaper sales (6%).

In Japan’s restaurant industry, some of the most important outsourcing isn’t about the production of the food or the outsourcing of accounting or HR, but rather about ordering ingredients. In the US, many restaurants can order most everything they need through the website of a company like Sysco. In Japan even the humblest restaurant typically deals with a dozen or more different suppliers: one purveyor might be a stall at the city’s main seafood market that only sells abalone; another could be a family-owned seaweed farm; another, a boutique agribusiness with an especially prized variety of heirloom cucumber. For the restauranteur, re-ordering historically required faxing or leaving voice mails with each supplier, draining precious hours each day from more productive activities.

“If anything, Infomart gives restaurants access to even more variety of authentic ingredients,” says Takayuki Hayano, a Harding Loevner Japan analyst. “It saves a tremendous amount of time but preserves the art and the magic.”

Infomart, a Tokyo-based internet company, has reduced this wasted time by enabling vendors and restauranteurs alike to scrap all that calling, faxing, billing, and record keeping. Twenty years ago, it created an e-commerce platform that made it possible for even the most technologically challenged scallion farmer or mollusk diver to operate a digital storefront. Eventually, as the interface and backend technology of Infomart’s platform improved, and more restaurants joined, it became all but impossible for a supplier to do business without accepting orders through the company. For the restauranteurs, the daily quest for ingredients has been reduced to a few clicks.

And this time saving has been accomplished without sacrificing the meticulous curation that lies at the heart of Japanese cooking. “If anything, Infomart gives restaurants access to even more variety of authentic ingredients,” says Takayuki Hayano, a Harding Loevner Japan analyst. “It saves a tremendous amount of time but preserves the art and the magic.”

Enter the Kuroko

If Infomart preserves the art and magic, Ariake makes the art and magic. The company was founded in 1966 by Kineo Okada, a man with so exceptional a palate he purportedly could replicate any soup he ate. Today, when a restaurant chain hits upon a winning soup or sauce recipe, it can provide a sample to Ariake to feed into its proprietary taste sensor machine that analyzes and encodes the flavor. A team of human super-tasters tests an initial batch for match and directs any needed tweaks to the formula. The formula is then plugged into the world’s most automated meat-based broth- and sauce-making process, the fruit of a series of automated innovations initiated by Okada in the 1990s after the company had begun to struggle to find enough qualified workers willing to toil away in its own facilities.

Hayano surmises that Ariake uses the same automation equipment available to other food companies, but it’s impossible to know for sure because management scrapes off the manufacturers’ labels before equipment is installed at its plants so even employees have no indication of its origins.

The automation methods Ariake has developed are fiercely guarded secrets. To develop them, Hayano surmises that Ariake uses the same automated equipment available to other food companies, but it’s impossible to know for sure because management scrapes off the manufacturers’ labels before equipment is installed at its plants so even employees have no indication of its origins.

Of the flavors recognized by human taste buds, umami, or savoriness, is among the most difficult for flavor manufacturers to produce.3 That is especially true for the ungulate-derived umami flavors that are Ariake’s specialty. At other companies, the production of meat-based soups, sauces, and flavorings involves stewing the ingredients in industrial kettles, a process that is generally automated. But then the product must go through a manual extraction stage—hundreds of hours of sweaty work as pickers remove steaming bones by hand to ensure no shards are left behind—before it can be transferred to an automated production line to make the finished flavor concentrate or freeze-dried bouillon.

By somehow managing to automate this most labor-intensive part of its operations, Ariake has helped itself to gross profit margins above 35%. That is on par with leading primarily plant- and synthetically derived flavors companies (where there are many fewer bones to pick) such as IFF, Givaudan, and Symrise, and a half dozen percentage points higher than the margin of an industrial soup maker like Campbell’s.

Source: www.ariakejapan.com

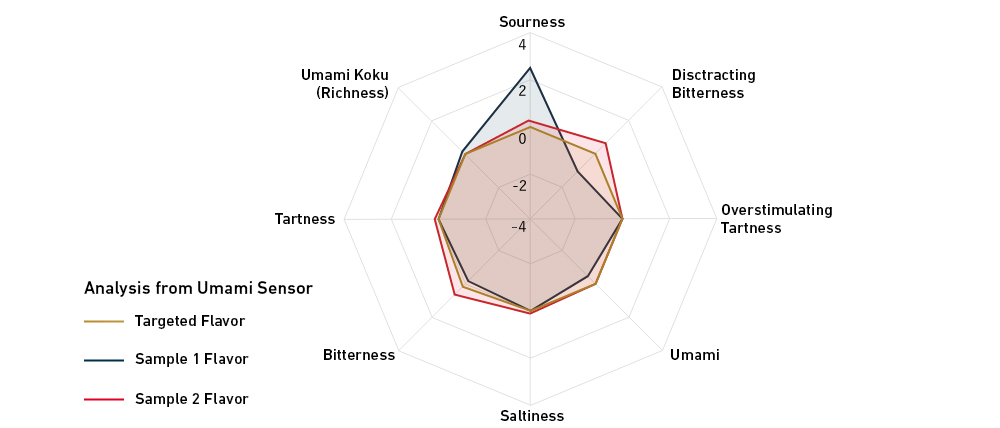

Ariake’s taste sensor machines can deconstruct any secret sauce into its precise flavor profile. Above, the umami sensor has measured two candidates for how close they get to matching a targeted flavor that maximizes both umami and umami “koku,” the richness or roundness of the savory qualities, while simultaneously striking an optimal balance between the more and less desirable types and concentrations of other flavors. These are some of the inputs that then drive the fully automated production line, below.

Source: www.ariakejapan.com

In a show aired in 2020, a Japanese TV crew was granted access to Ariake’s main production facilities on Kyushu. During the segment, Ariake’s now-CEO Naoki Shirakawa—donning a black-hooded robe—likened his company to the kuroko, a shrouded character in traditional Japanese theater who hovers in the background and aids the performances of others by moving scenery on stage or helping with costume changes, while keeping their own identity hidden. Ariake’s clients are no more forthcoming than Ariake about their relationship with the company. Identification of Ariake’s clients can only be made through hints in new product releases or by scouring disclosures related to Japanese companies’ penchant for holding shares in other companies with which they do business. This is how Hayano and Sakai deduced the Ippudo connection and Ariake’s other tentacles into the ramen scene. They have also come across Ariake’s name in the fine print in the disclosures of flavors manufacturers with which Ariake competes—implying that even some of these have come to rely on Ariake for certain flavors.4

Overall, Ariake’s revenues skew heavily (80%) toward Japan. However, in 2018, the company reorganized its overseas operations. Faced with a need to upgrade its older facilities in the US, Ariake sold the operations servicing its US-based clients to Kerry Group, an Ireland-headquartered ingredients and prepared food purveyor. Ariake now focuses on the world’s biggest markets for meat-based sauces and other umami flavors: Europe and China.

China’s aging process is about 30 years behind Japan’s, but accelerating. With its working-age population contracting by 1.7% a year, Chinese food manufacturers and food service companies are moving to automate. Property management giant Country Garden Services and e-commerce retailers Alibaba and JD.com have launched pilot-project restaurant chains where robots do most of the cooking and serving.

China has over 6 million restaurants, three times as many as the US and Japan combined. That includes quite a few spots with their own dreams of expansion—for whom a Japanese supplier, known for its precision replication and mass-production of one-of-a-kind master soups or sauce stocks, could be a godsend.

What did you think of this piece?

Contributors

Director of Research Yoko Sakai, CFA and Analyst Takayuki Hayano, CFA contributed research and viewpoints to this piece.

Endnotes

¹“Estimates for the Labor Market in 2030,” Persol Research Institute (October 2018).

²“Japan Loves Robots, But Getting Them to Do Human Work Isn’t Easy,” The New York Times (December 31, 2019).

³Umami, the “fifth taste,” was not even officially recognized until 2002. Since then, Japanese scientists claim to have discovered the taste buds for a sixth, called kokumi, or the “taste of koku,” a term long used in Japanese cuisine implying enhanced deliciousness coming from the richness or roundness of a flavor.

⁴On its website, Ariake does disclose having had a long-running partnership with the restaurant empire of the late legendary multiple Michelin-awarded chef Joël Robechon, but that relationship has been dormant since 2015.

Disclosures

The “Fundamental Thinking” series presents the perspectives of Harding Loevner’s analysts on a range of investment topics, highlighting our fundamental research and providing insight into how we approach quality growth investing. For more detailed information regarding particular investment strategies, please visit our website, www.hardingloevner.com. Any statements made by employees of Harding Loevner are solely their own and do not necessarily express or relate to the views or opinions of Harding Loevner.

The information provided is as of the publication date and may be subject to change. Harding Loevner may currently hold or has previously held positions in the securities referenced, but there is no guarantee that Harding Loevner currently owns, or has ever owned, the securities mentioned herein. If Harding Loevner owns any of these securities, it may sell them at any time.

Any discussion of specific securities is not a recommendation to purchase or sell a particular security. Non-performance based criteria have been used to select the securities identified. It should not be assumed that investment in the securities identified has been or will be profitable. To request a complete list of holdings for the past year, please contact Harding Loevner.

There is no guarantee that any investment strategy will meet its objective. Past performance does not guarantee future results.

© 2025 Harding Loevner

Disclosures

The “Fundamental Thinking” series presents the perspectives of Harding Loevner’s analysts on a range of investment topics, highlighting our fundamental research and providing insight into how we approach quality growth investing. For more detailed information regarding particular investment strategies, please visit our website, www.hardingloevner.com. Any statements made by employees of Harding Loevner are solely their own and do not necessarily express or relate to the views or opinions of Harding Loevner.

The information provided is as of the publication date and may be subject to change. Harding Loevner may currently hold or has previously held positions in the securities referenced, but there is no guarantee that Harding Loevner currently owns, or has ever owned, the securities mentioned herein. If Harding Loevner owns any of these securities, it may sell them at any time.

Any discussion of specific securities is not a recommendation to purchase or sell a particular security. Non-performance based criteria have been used to select the securities identified. It should not be assumed that investment in the securities identified has been or will be profitable. To request a complete list of holdings for the past year, please contact Harding Loevner.

There is no guarantee that any investment strategy will meet its objective. Past performance does not guarantee future results.

© 2025 Harding Loevner