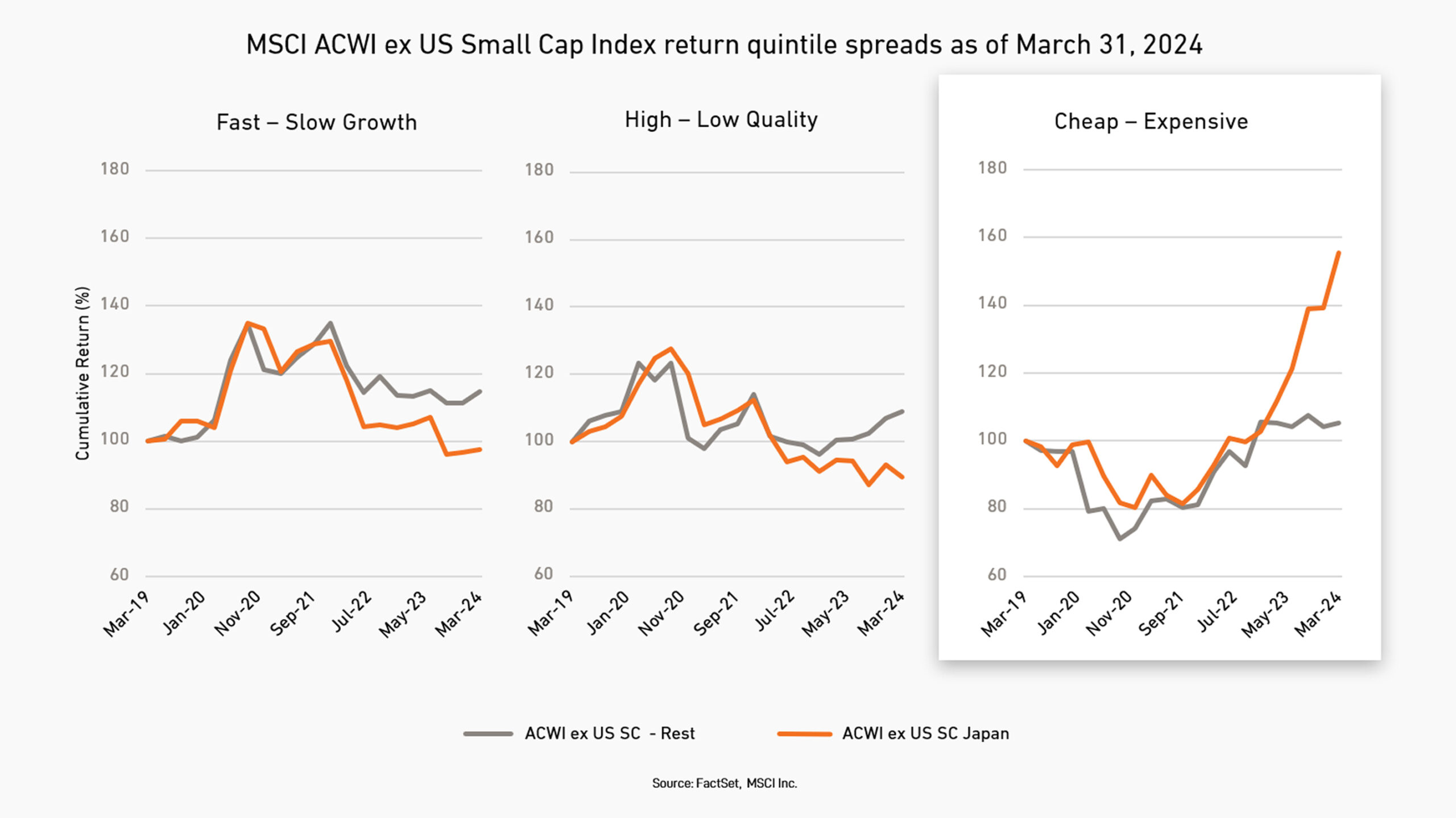

International small caps continue to trade near their cheapest valuations relative to international large caps since the 2009 global recession. Although they are also valued at a discount to US small caps, the spread hasn’t changed much over the last two decades.

Even relative to their own historical valuation multiples, international small caps look cheap, with the MSCI All Country World ex US Small Cap Index trading at a price-to-earnings ratio of 14.8, 19% below its 2021 peak. This indicates there is an attractive valuation opportunity for small-cap investors, especially with respect to some high-quality, fast-growing international small companies. ∎