The following is based on a panel discussion among our retail analysts at the Harding Loevner 2024 Investor Forum.

The three most important considerations for companies in the retail industry are product, price, and place. This is because a retailer generally differentiates itself through what it sells, how much it charges, or how convenient it is for customers to shop there. Therefore, when new rivals enter the industry, they tend to target perceived shortcomings in one or more of these areas.

The clearest example of how these dynamics can play out has been the rise of e-commerce over the past two decades. Websites such as Amazon.com were able to take market share from store-based retailers by providing shoppers a greater assortment, price transparency and savings, and the ability to shop from their homes.

Now, a new class of online retailers is finding room to further disrupt the 3Ps of retail by offering deep discounts on trendy apparel and other impulse purchases. They include Shein, a company that is aiming to go public soon, Temu, a subsidiary of China’s PDD Holdings, as well as TikTok Shop, a shopping feature that was added to the namesake social-media app owned by China’s ByteDance. (While Shein has moved its headquarters to Singapore, its operations are also primarily in China.) All three cross-border operators are bringing specific competitive advantages to large retail markets such as the US and Brazil.

Perhaps because consumers in the US and elsewhere are accustomed to seeing “made in China” tags on their clothing, there is a misconception that China was always the domain of fast fashion—cheap, rapidly produced apparel that mimics catwalk trends. Traditionally, though, production and shipping lead times were longer in China, making it a more suitable supplier for brands such as Nike than retailers trying to quickly recreate viral looks. Leading fast-fashion retailers such as Inditex, the Spanish parent of Zara, and the British e-ecommerce site ASOS source only about 30% to 40% of their merchandise from China and often turn to countries such as Spain, Portugal, Morocco, and Turkey for styles requiring a quicker turnaround.

Shein and Temu, however, mostly rely on Chinese suppliers, and they’re able to offer low prices in part because of the method they use to get their products from those suppliers to shoppers. By shipping individual orders directly to customers, they avoid US import duties, which are waived if a shipment’s value is less than US$800. US lawmakers have called this an unfair advantage over American retailers, many of which do pay import duties to bring in inventory made overseas. Duties, particularly in countries with high duties, can be a meaningful component of costs, although their avoidance isn’t the only reason Shein and Temu can offer low prices. Another is the efficiency of their supply chains and logistics operations.

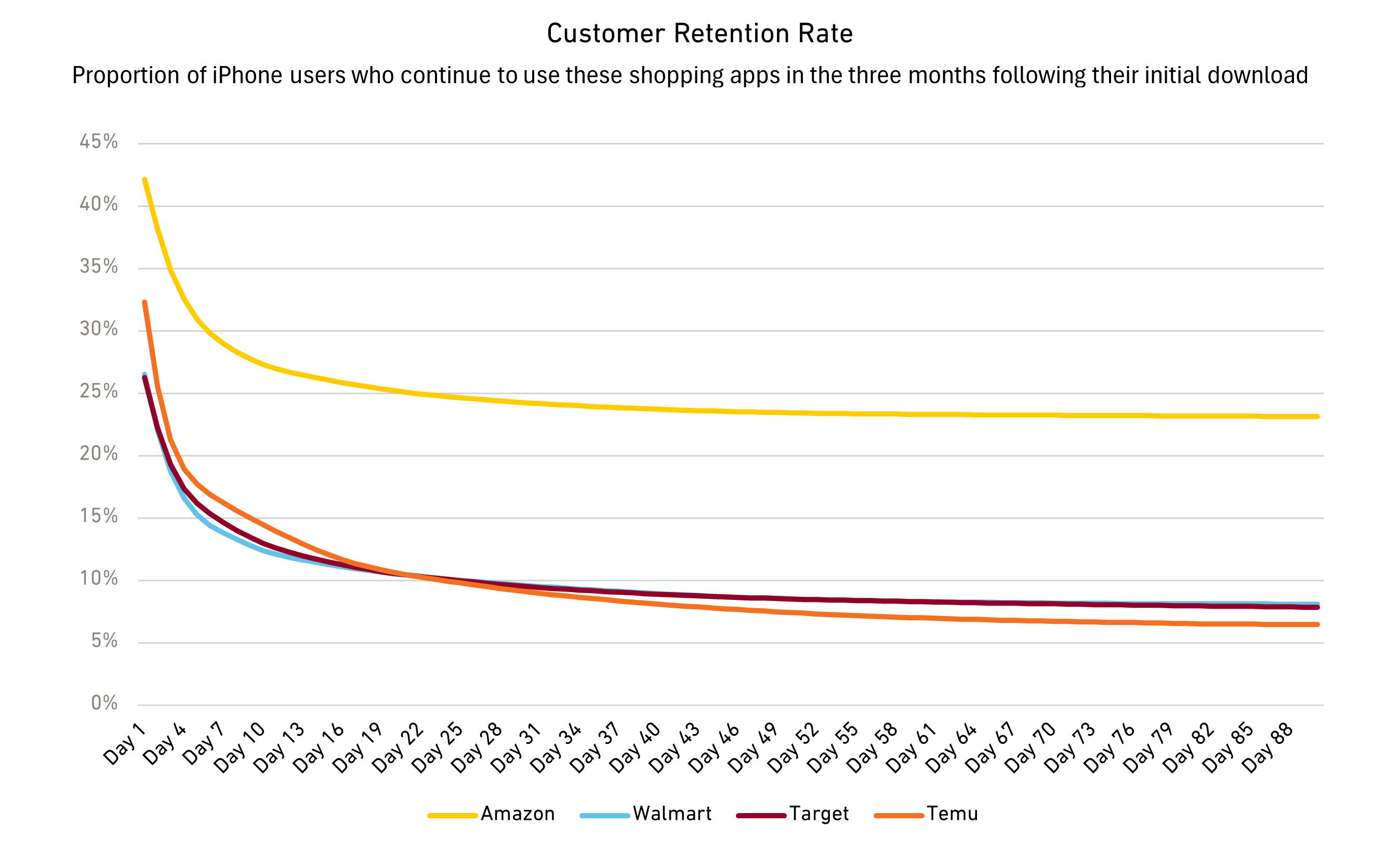

But while these relative newcomers have been popular with some consumers, there doesn’t appear to be much risk to high-quality retail companies. One reason is that the retail market pie is so large, which means the rivalry dynamics are such that many different strategies can succeed at the same time. For example, even after getting off to a gangbuster start in the US, Temu’s gross merchandise value represents just 1% of the US e-commerce market, putting it significantly behind Amazon at 38% and even Walmart at 6%. Its customer retention rate is also lower, suggesting that some shoppers may be drawn to the novelty of scoring a deal but aren’t becoming repeat customers. The Sensor Tower data below shows the proportion of Apple iPhone users who open the Temu app at least once a month after downloading and how that compares to other retail apps; the large drop-off in Temu visitors is true among Android users as well:

Source: Sensor Tower

To offer such low prices, Shein and Temu also can’t provide the speedy shipping that American shoppers have come to expect from companies with robust local distribution infrastructure, such as Amazon and Walmart. Instead, the packages can take a week or longer to arrive from China. This is one reason that the risk to sales of large, easily accessible US discounters such as Amazon and Walmart, which has over 4,600 stores in the US—more than one for every US county—appears to be low.

Where Shein has somewhat differentiated itself is in its use of artificial intelligence (AI), which helps it quickly respond to fashion trends and accelerate production of items that are expected to be in high demand. It’s a strategy that other retailers with high financial resources can replicate. AI may prove particularly advantageous for online marketplaces because of the tremendous amount of data that is captured by a company’s relationship with a large mix of buyers, sellers, and goods. So far, though, most of what the retail industry has done with AI doesn’t appear to be game-changing. In fact, there are cautionary tales in which brands have put too much emphasis on technology and the product suffered as a result. For example, Adidas said in 2019 that it over-invested in digital advertising and focused too much on the number of shoppers clicking its ads rather than its overall brand perception.

The category of retailers that would seem to be most at risk from competition from Shein and Temu are dollar stores given the similarities in product selection and prices. But even dollar stores have some differentiating characteristics. For example, many sell items that the Chinese apps don’t, such as consumables. They also offer convenience for shoppers in need of an item quickly and the ability to inspect a product in person rather than scrolling through a long list of options. So far, new online challengers haven’t had a material impact on the dollar-store industry.

Overall, high-quality specialist companies have continued to grow despite the success of new challengers such as Shein and Temu. It’s because of their differing strategies around product, price, and place that the barriers to entry in retail are higher than most might assume. However, it is possible that market-share gains by Shein and Temu will shake the stock-price sentiment for even some high-quality retailers, which may produce more attractive valuations and potential buying opportunities.