The past several years have not been kind to Germany’s economy. The country’s chronic underinvestment in infrastructure, high energy prices, declining household consumption, and low fixed capital formation led to a long period of economic stagnation, contributing to the breakup last year of Chancellor Olaf Scholz’s unpopular three-party coalition and, in turn, the collapse of the German government. The trade outlook also worsened over the past year, amid increased competition from Chinese manufacturers as well as rising geopolitical instability.

However, some businesses, due to the combination of their revenue makeup, financial strength, and other advantages, have been relatively resilient to the country’s economic woes and gained an edge over their rivals. Two examples are Scout24, which owns Germany’s most popular real estate portal, and Nemetschek, a provider of 3-D design and modeling software for the construction industry. In both cases, investors worried about a gloomy macroeconomic outlook failed to appreciate the unique qualities that have helped these businesses to continue growing.

Housing affordability has been a significant challenge in Germany. After home prices soared 80% from 2012 to 2022, it didn’t take much for higher interest rates to tip the country’s housing market into a downturn. Yet, despite the downturn, Scout24 managed to increase sales by double digits in 2023 and 2024. How? In a weak housing market, sellers and agents are forced to increase spending on marketing to help houses sell. Scout24 also has an advantage given that its portal, ImmoScout24, captures nearly 70% of the money spent on digital advertising for real estate in Germany, which gives the company pricing power.

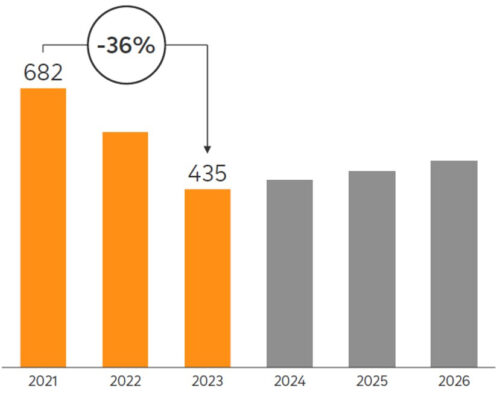

Number of Real Estate Transactions

(thousands)

Source: Scout24 Capital Markets Day Presentation, GEWOS IMA Info 2023: Immobilienmarkt Deutschland

Number of residential and commercial real estate transactions without property land.

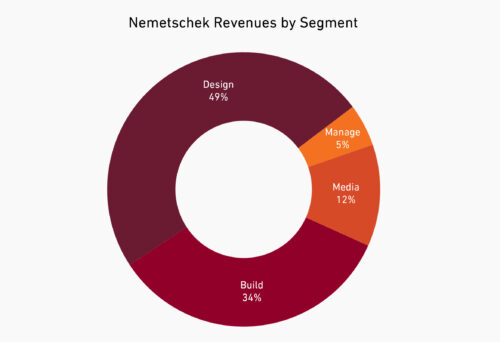

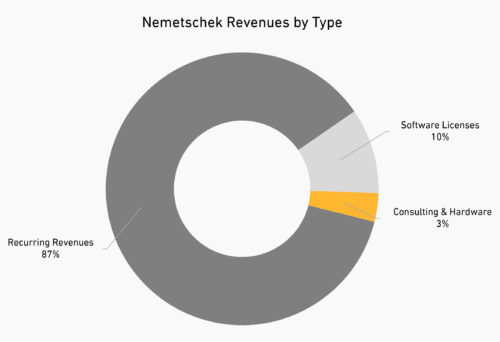

In the case of Nemetschek, the company has differentiated products and strong customer relationships, which in addition to its financial strength and strong cash flows have helped it to weather hard times. The long-term growth trends—rising adoption of modeling technology by the construction industry as well as more people moving to cities and spurring redevelopment—also remain intact. In fact, the main effect that the economic environment seems to have had on Nemetschek was to its valuation, which fell alongside that of other long-duration growth companies once interest rates rose.

Source: Company disclosure, Harding Loevner analyst estimates. Data as of March 31, 2025.

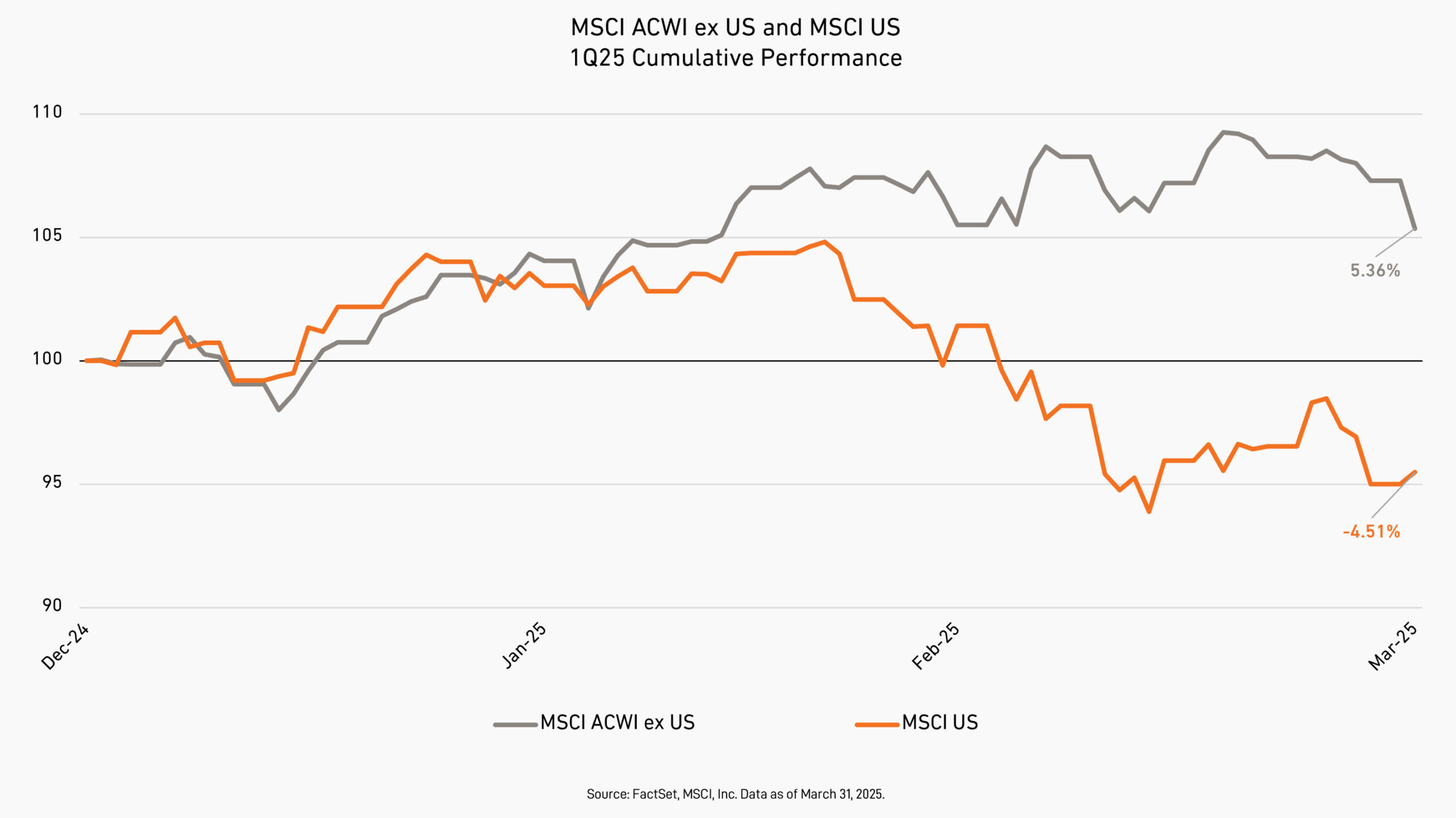

More recently, investor sentiment toward Germany has improved—it was even the top-performing country, by weight, in the international small-cap benchmark in the first quarter. Not only have protectionist trade policies under the Trump administration shaken investor confidence in the US economy vis-à-vis Europe’s, but also, in mid-March, Germany announced a historic fiscal stimulus plan. As part of the plan, the government will partly exempt defense and infrastructure spending from a strict debt rule that was added to its constitution in the wake of the 2008 global financial crisis. Lifting this so-called debt brake enables Germany to join the rest of Europe in building up its defense capabilities, while also embarking on a plan to fund more than US$500 billion in digital, energy, and transportation infrastructure. A variety of companies and industries stand to benefit from this new spending.

However, the trade war presents new challenges. Although small-cap companies tend to be more focused on their domestic markets, which limits their exposure to tariffs, a slowdown in global economic growth is likely to have an outsized effect on small caps, as they are generally more sensitive to growth expectations than large caps. Therefore, in a risky world, it makes all the more sense to emphasize companies whose profits and growth have shown to be relatively resilient to economic disruption. ∎