A year ago, we argued that the long-running dominance of US equities might be at a tipping point. US stocks had outperformed overseas peers from 2009 through 2024, but domestic valuations were stretched and markets priced for perfection, while international markets were trading at steep discounts and expectations were very low. That argument looks good right now. Through October 27, the MSCI EAFE Index returned 29% in 2025, significantly better than the 18% return for the S&P 500.

This year’s performance gap in favor of non-US equities reflects policy concerns at home and improving fundamentals abroad. But after such a long period of US equities dominance, investors still aren’t sure that it’s a lasting change. After a mere ten months, is the non-US trade over? We don’t think so. We still believe market leadership is changing hands. But these kinds of shifts are clearer in hindsight than in the moment, and the path is rarely straightforward.

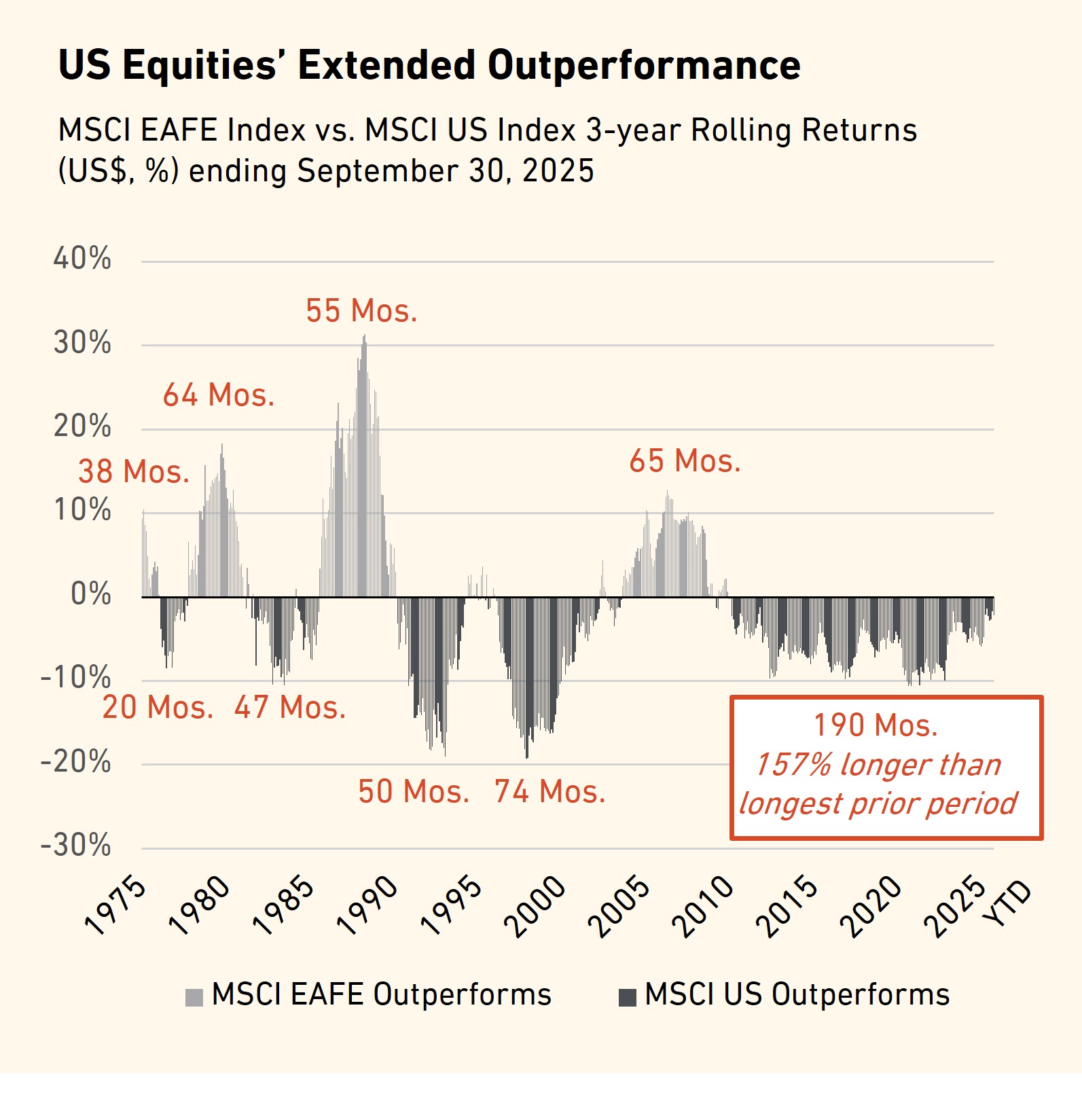

For the 15 years before this year, that path led decisively to the US. Superior corporate earnings, economic growth, and policy and institutional stability helped justify a premium valuation for US stocks, while international markets faced challenges including prolonged economic stagnation in parts of Europe and regulatory risk and economic decline in China. In the years since the pandemic, there has been an added challenge for investors such as us: the rapid rise of interest rates and persistent inflation prodded investors in international markets to cyclical businesses, while the stocks of quality and growth businesses lagged. Finally, across 2023 and 2024 the momentum of a concentrated group of AI-related stocks turbocharged the belief in US exceptionalism and pushed the valuation gap to unprecedented levels. On a rolling three-year basis, the most recent period of US outperformance has lasted 190 months—a bit more than 15 years—more than two-and-a-half times longer than the longest prior period.

Source: Bloomberg, MSCI Inc.

But history shows such long periods of outperformance do not persist indefinitely, and today there are cracks in the US exceptionalism thesis that pose a risk to both US stocks and this long period of outperformance. US policy uncertainty seems to have damaged the perception of US exceptionalism and galvanized Europe. Meanwhile, the success of the Chinese AI platform DeepSeek rattled investors in US tech stocks in February of this year and demonstrated there is AI innovation beyond the US. Innovation and growth by non-US companies, shifting policies here and abroad, US dollar weakness, and valuation differences all underscore a passing of the torch. And while valuation was not the catalyst for recent international outperformance, the size of the discount provides some fuel and can support further gains. Simply narrowing the valuation gap back to average historic levels provides a long runway for further non-US stock outperformance. Given all that, we believe non-US stocks will lead the way over the next several years.

US Companies May Not Be Good Proxies for Non-US Markets

A rationale we often hear is that these changes aren’t crucial, because investors in US companies get overseas exposure through US companies doing business abroad. This may be the case today but it may not be the case in the future. About 42% of the revenues of S&P 500 companies (as of October 27) come from outside the US, the result of a long period of open trade and cooperation across global markets. In a more fragmented and protectionist environment, those revenues may dwindle, possibly significantly. American companies could face greater barriers to operating abroad under the current administration’s evolving approach to global trade.

But this doesn’t mean that global trade itself will shrink. In fact, the opposite appears to be happening. During President Trump’s first administration, exports from China to the US fell. However, trade between China and several other regions—Africa, Latin America, Russia, and eastern Europe—rose. And that trend has persisted. Put another way, global trade has continued to expand but the US is capturing less of that growth. That creates opportunities for companies headquartered outside the US to develop and grow markets for their products.

Source: Deutsche Bank, Haver Analytics. Reproduced with permission.

In other words, relying on US multinationals for international exposure may become less effective as an investment strategy. An allocation to non-US stocks could provide investors with more direct participation in the growth of global trade.

Is Current US Policy Helping or Hurting?

Current US policy has resulted in rising debt, market volatility, and political uncertainty, all of which has weakened the perception of the US as a safe haven. Valuations remain high relative to other regions, partly because of the dollar’s historical strength and the long-standing assumption of US institutional stability. But when that stability is questioned, both valuations and the currency can come under pressure, as they have this year. The dollar fell 11% in the first six months of 2025, its worst first-half performance since the 1970s, and was down 9% through October 27. A weaker dollar creates an incentive for US investors to deploy capital abroad, where returns may be more favorable once converted back into dollars.

Meanwhile, governments overseas are promoting growth- and equity-friendly policies. European policymakers, having observed the benefits of stimulus acts in the US, are preparing a significant boost in stimulus spending, focused on investment, regulatory easing, and R&D support. Mario Draghi, the former president of the European Central Bank, argued in a 2024 report that Europe must raise investment by about 5% of GDP to drive digitalization, decarbonization, and defense—a level of spending that would outpace the Marshall Plan. Japan is modernizing, moving business processes from paper to cloud with firm deadlines, and committing 150 trillion yen to energy transition. And China, after years of sluggishness, is pushing for self-sufficiency across a wide range of industries including semiconductors, advanced materials, aerospace, and biotech. This effort is backed by heavy state investment in R&D and life sciences infrastructure, new regulatory moves to reopen IPO access for early-stage firms, as well as massive government guidance funds and venture capital initiatives.

In the search for the best risk-adjusted returns, the US is no longer the only option. This year, earnings growth among stocks in European indexes has begun to improve with forecasts for double-digit EPS growth over the next year. Meanwhile, the US fiscal situation remains rather weak, policy is chaotic, and the economy is sluggish, none of which are conditions for strong growth. At this point, overseas markets may offer better conditions for earnings growth and potential for rising valuations as more investors recognize the potential. Improved earnings growth on its own may be enough to attract capital, but the combination of earnings growth and improving valuations would be a powerful combination supporting investment returns. ∎